Quick Navigation

Understanding UAE E-Invoicing ASPs

Accredited Service Providers (ASPs) are technology partners authorized by the UAE Ministry of Finance to validate, exchange, and transmit e-invoices in compliance with the UAE mandate under Article 16 of Ministerial Decision No. 64 of 2025.

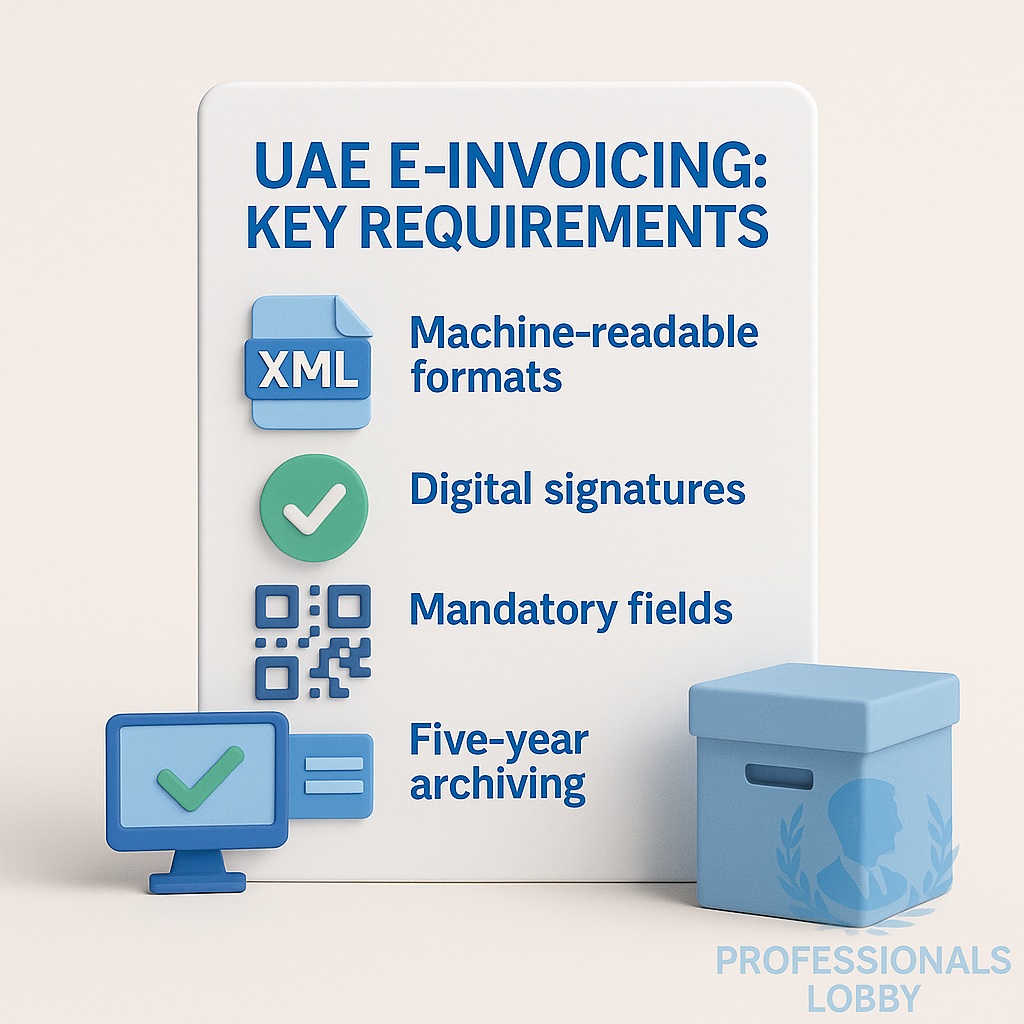

Validation & Compliance

ASPs ensure invoice structure, mandatory fields, and PEPPOL/PINT-AE formatting compliance

Secure Transmission

Provide secure channels for B2B, B2G, and self-billing invoice transmission to FTA

ERP Integration

Offer APIs, connectors, and integration with major ERP and accounting systems

Data Archiving

Secure storage and retrieval of e-invoices as per UAE regulatory requirements

Ministry of Finance Pre-Approved ASPs

Comarch Middle East FZ LLC

Pre-ApprovedCygnet Digital IT Solutions L.L.C

Pre-ApprovedDefmacro Software DMCC (ClearTax)

Pre-ApprovedDeloitte & Touche M.E

Pre-ApprovedFlick Network L.L.C

Pre-ApprovedOxinus Holding Limited

Pre-ApprovedPagero Gulf FZ-LLC (Thomson Reuters)

Pre-ApprovedSkill Quotient Technologies (SMARTeIS)

Pre-ApprovedSunTec (Xelerate) Business Solutions DMCC

Pre-ApprovedDetailed ASP Comparison

Comprehensive feature-by-feature analysis of all pre-approved e-invoicing ASPs in the UAE market.

| ASP Provider | UAE Status | PEPPOL/PINT-AE Focus | ERP Integration Breadth | Best Fit For | Key Strengths |

|---|---|---|---|---|---|

| Comarch Middle East | Pre-Approved | Strong, frequent updates | Broad/global coverage | Multinational corporations | Global e-invoicing expertise, deep PEPPOL compliance |

| Cygnet Digital | Pre-Approved | Strong 5-corner model | Broad regional coverage | Mid to large UAE enterprises | Regional experience, flexible API connectors |

| ClearTax (Defmacro) | Pre-Approved | PEPPOL-ready claims | Broad (SaaS focus) | SMEs to mid-market | Fast onboarding, cost efficiency, cloud-native |

| Deloitte M.E | Pre-Approved | Advisory + enablement | Advisory/integrator model | Large transformations | Advisory-led delivery, governance expertise |

| Flick Network | Pre-Approved | UAE mandate focus | Mid-market connectors | Mid-market, distributors | Quick integrations, local implementation support |

| Oxinus Holding | Pre-Approved | Enterprise ecosystem | Enterprise projects | Government/large enterprise | Digital ecosystem provider, multi-domain support |

| Pagero (Thomson Reuters) | Pre-Approved | Global AP/network strength | Very broad, multinational | Global groups | Global PEPPOL network, extensive ERP compatibility |

| Skill Quotient (SMARTeIS) | Pre-Approved | PEPPOL-based platform | SAP-heavy guidance | UAE enterprises (SAP) | SAP ecosystem alignment, hands-on integration |

| SunTec (Xelerate) | Pre-Approved | Enterprise-grade | BFSI/large enterprise | Banks/large corporates | BFSI specialization, complex billing expertise |

Key Feature Analysis

Detailed breakdown of critical capabilities across different ASP categories.

Global vs Local Focus

ERP Integration Capability

PEPPOL/PINT-AE Compliance Status

Pagero, Comarch, Cygnet, Deloitte

ClearTax, Flick, Skill Quotient

SunTec, Oxinus, Deloitte

ASP Selection Guide

Structured approach to choosing the right e-invoicing ASP for your business requirements.

Operating Model Fit

Evaluate managed service vs. DIY connectors and local vs. global support footprint

- Assess internal technical capabilities

- Determine preferred support model

- Consider multi-country requirements

PEPPOL Capability

Confirm PINT-AE support and connectivity testing for billing scenarios

- Validate PINT-AE schema compliance

- Test credit/debit note handling

- Verify self-billing capabilities

Integration Depth

Evaluate native adapters for your ERP and message queuing options

- Check pre-built ERP connectors

- Assess API documentation quality

- Review ESB integration options

Performance & SLAs

Validate throughput, validation latency, and uptime guarantees

- Review service level agreements

- Test system performance

- Validate disaster recovery plans

Security & Data Residency

Ensure encryption, key management, and UAE hosting compliance

- Verify data encryption standards

- Check UAE data center options

- Review audit trail capabilities

Roadmap & Updates

Assess frequency of schema updates and regression testing commitments

- Review update frequency

- Check testing methodologies

- Validate compliance monitoring

Implementation Roadmap

Structured approach to successful e-invoicing ASP implementation and compliance.

Requirements Assessment

Comprehensive analysis of current invoicing processes and compliance gaps

ASP Evaluation & Selection

Structured RFP process and vendor evaluation based on business requirements

Integration & Configuration

Technical implementation, ERP integration, and system configuration

Testing & Validation

Comprehensive testing of invoice generation, transmission, and compliance

Go-Live & Support

Production deployment, user training, and ongoing support

Business Profile Recommendations

Tailored ASP recommendations based on different business profiles and requirements.

Global Multinational

Recommended ASPs:

Key Considerations: Global PEPPOL network coverage, multi-country compliance, extensive ERP connector library

UAE Mid-Market

Recommended ASPs:

Key Considerations: Quick implementation, cost efficiency, local support, mid-market ERP focus

Banks & Financial Services

Recommended ASPs:

Key Considerations: Complex billing expertise, enterprise security, regulatory compliance, scalability

SAP-Heavy Enterprise

Recommended ASPs:

Key Considerations: SAP ecosystem expertise, hands-on integration support, custom development capabilities

Professionals Lobby E-Invoicing Services

Gap Analysis & Assessment

Comprehensive evaluation of current systems and compliance requirements

Vendor Shortlisting

Structured RFP process and ASP evaluation based on your business needs

Implementation Oversight

End-to-end project management and technical implementation support

Compliance Assurance

Ongoing monitoring, testing, and audit readiness services

Important Disclaimer

This article is prepared using publicly available information and AI-backed analysis as of October 2025. The UAE e-invoicing landscape is evolving rapidly, and the Ministry of Finance may update the list of pre-approved ASPs or modify requirements at any time.

Official Reference Sources:

- UAE Ministry of Finance - E-Invoicing Accreditation

- Federal Tax Authority - E-Invoicing Guidelines

- Official ASP List and Contact Details (MoF PDF)