The UAE Federal Tax Authority (FTA) is preparing to implement mandatory electronic invoicing (e-invoicing) as part of its digital transformation of tax administration. This comprehensive guide examines what businesses need to know about the upcoming e-invoicing mandate, drawing lessons from Saudi Arabia's ZATCA model and outlining practical steps for compliance.

With the UAE's e-invoicing system expected to roll out in phases starting 2024-2025, companies must begin preparing their ERP systems, accounting processes, and compliance workflows now to avoid penalties and operational disruptions.

The Road to E-Invoicing: UAE vs Saudi Arabia (ZATCA)

Saudi Arabia's successful implementation of e-invoicing through ZATCA provides valuable insights for UAE businesses:

| Aspect | UAE (Expected) | Saudi Arabia (ZATCA) |

|---|---|---|

| Implementation Phases | Likely 2 phases: Voluntary then Mandatory | Generation Phase (Dec 2021) + Integration Phase (Jan 2023) |

| Technical Format | XML/UBL expected with digital signatures | XML/PDF-A3 with QR codes and cryptographic stamps |

| Integration Method | FTA portal or direct API integration | ZATCA Fatoora platform with real-time clearance |

| Penalties | To be announced (expected similar to VAT penalties) | SAR 5,000-50,000 per violation |

Key lesson from ZATCA: Early adopters faced fewer disruptions than last-minute compliers. UAE businesses should begin preparations now.

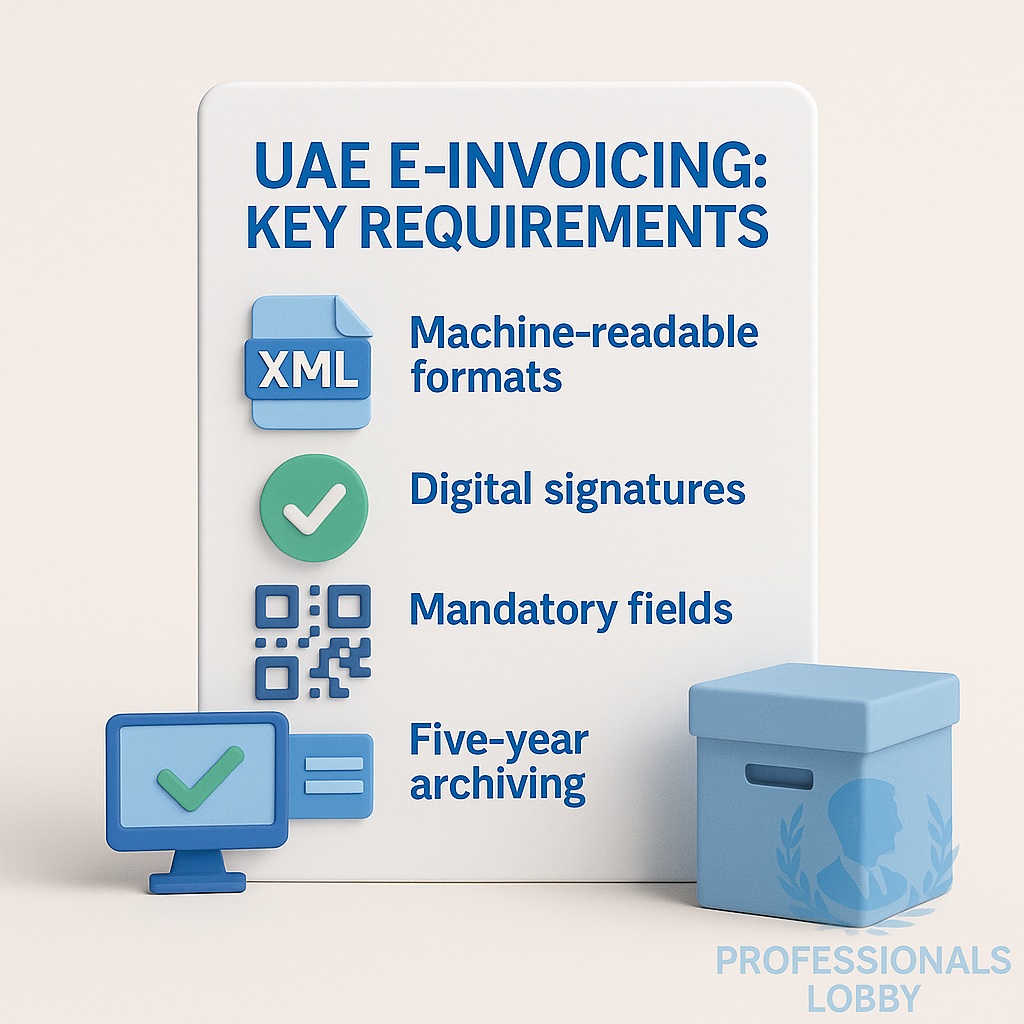

UAE E-Invoicing: Key Requirements

Based on FTA announcements and regional precedents, UAE e-invoices will likely require:

- Machine-readable formats: XML or UBL (not just PDF)

- Digital signatures or cryptographic stamps for authenticity

- Mandatory fields including QR codes, sequential numbering, VAT details

- Real-time reporting or periodic submission to FTA portal

- Five-year archiving with integrity checks

Expected mandatory fields in UAE e-invoices based on FTA requirements

ERP System Readiness Checklist

Most UAE businesses will need to upgrade their ERP or accounting systems to comply. Essential capabilities include:

- Generate invoices in XML/UBL format (not just PDF/Excel)

- Integrate with FTA systems via API for submission/clearance

- Apply digital signatures and sequential numbering

- Automate QR code generation with required invoice data

- Maintain complete audit trail of all invoice versions

- Support five-year archival with integrity checks

Popular ERP systems in UAE like SAP, Oracle, Microsoft Dynamics, and Zoho are already developing FTA-compliant modules.

Legal & Compliance Considerations

Beyond technical requirements, businesses must address:

Contract Updates

Review customer/vendor contracts for e-invoicing clauses and payment terms

Data Privacy

Ensure GDPR and UAE data protection compliance for invoice data

B2B/B2C Differences

Different rules may apply for business vs consumer invoices

Archival Policy

Implement WORM (Write Once Read Many) storage for audit compliance

Business Benefits of E-Invoicing

While compliance is mandatory, e-invoicing offers significant advantages:

- Faster payments: Digital invoices reduce processing time by 60-80%

- Cost savings: Eliminate paper, printing, and postage costs

- Fewer errors: Automated validation reduces manual entry mistakes

- Better cash flow: Real-time tracking of invoice status

- Simplified audits: Complete digital trail of all transactions

Early adopters in Saudi Arabia reported 30-50% efficiency gains in accounts receivable processes.

Implementation Challenges

Businesses should anticipate and plan for these common hurdles:

System Integration Complexities

Legacy ERP systems may require middleware or custom development to meet FTA requirements, particularly for:

- Digital signature implementation

- Real-time FTA API integration

- QR code generation logic

Change Management

Resistance from staff accustomed to paper/manual processes requires:

- Comprehensive training programs

- Updated SOP documentation

- Gradual phased rollout

AI & Automation in E-Invoicing

Emerging technologies can streamline compliance and add value:

Smart Validation

AI checks for missing fields, incorrect VAT calculations before submission

ERP Integration

ChatGPT-style interfaces help map legacy data to FTA XML schemas

Customer Support

AI chatbots handle common e-invoice queries from customers/vendors

Analytics

Machine learning identifies payment trends and cash flow opportunities

Tools like ChatGPT can assist with template generation, error detection, and compliance documentation.

Step-by-Step Preparation Roadmap

Recommended timeline for UAE businesses:

Assessment Phase

- Gap analysis of current systems

- Vendor evaluation for ERP upgrades

- Budget approval for compliance project

Implementation Phase

- System upgrades and testing

- Process redesign and documentation

- Staff training programs

Go-Live & Optimization

- Pilot testing with select customers

- Full rollout and monitoring

- Continuous improvement

Key Takeaways

The UAE's e-invoicing mandate represents a significant digital transformation for businesses. By learning from Saudi Arabia's ZATCA experience and beginning preparations early, companies can:

- Avoid last-minute compliance risks and penalties

- Leverage technology for operational efficiencies

- Position themselves as digitally advanced partners

Need Help Preparing for UAE E-Invoicing?

Our team of ERP and tax specialists can assess your readiness, recommend solutions, and manage the entire implementation process.

Schedule Compliance Consultation